- Rich Nerd

- Posts

- $17,000 in Debt & $0 Savings at 29

$17,000 in Debt & $0 Savings at 29

My Rich Nerds,

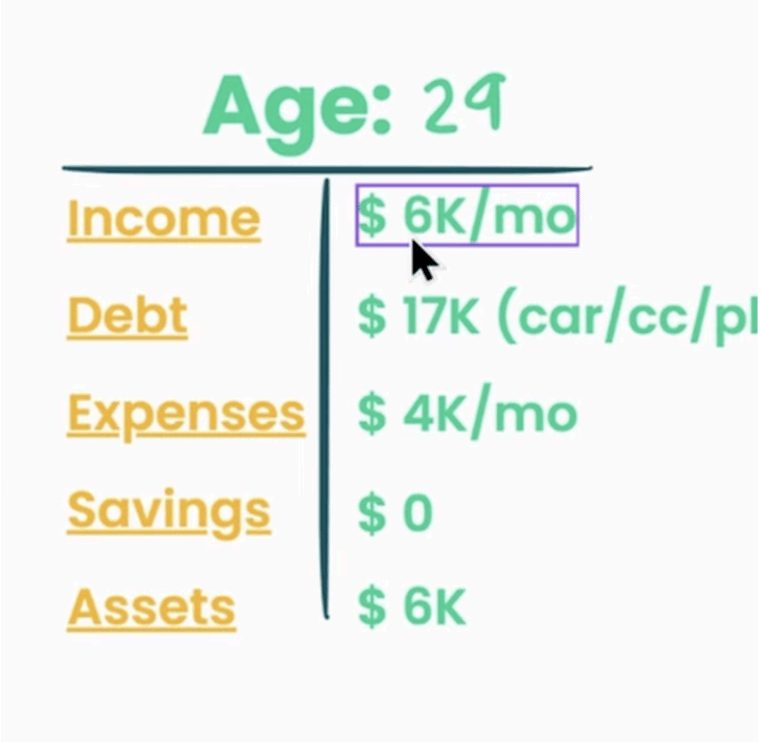

He’s 29 — dangerously close to that “dirty 30”— and earns $6,000 per month. Yet he’s saddled with $17,000 in debt and has $0 in savings. According to Fidelity, he is financially behind. I agree, BUT…he has plenty of time to get back on the main quest (for my non-gamer friends, this means “get back on track”).

Backstory

He started in service jobs: In-N-Out, Baskin-Robbins — and honestly, I like to joke that Baskin-Robbins should add a 32nd flavor: “Financial Freedom.” Because that’s the sweetest one on the menu. He’s currently in the pool-servicing business, slowly but steadily building up his own client list while still working for another company. Because one day he wants to run his own operation (huge respect, as entrepreneurship is extremely challenging).

He’s also not doing this alone. He’s in a committed relationship. She’s working at Starbucks while going through a nursing program, with about a year and a half left before she finishes. Together, they’re raising two young kids.

Let’s take a look at his numbers.

|  |

My Initial Thoughts:

He earns $6,000/month (a great income) and has $4,000 in expenses. Meaning, he should have $2,000 left over—yet he has $0 in savings. How is this possible? The culprit is typically a lack of automation. Saving money is like flossing; for most, it’s an afterthought (reply to this email if you LOVE flossing like me). If people see money in their checking account, they’re inclined to spend it.

Having something in savings — even just $2,000 — changes everything! It sounds like a gimmick, but data shows that a tiny emergency fund can boost your happiness, confidence, and sense of control.

“‘YoU nEeD 7 sTrEaMs oF iNcOmE” — social media pushes this like it’s the only path to financial success. Content creation, real estate, cat-sitting… apparently, you’re supposed to do everything at once. But here’s the truth: you only need one good income stream.

Your income is like your ultimate ability in a video game—your ulti. You can be losing for 90% of the match, but a well-timed ultimate can completely swing the game. That’s how powerful a solid, meaningful career path actually is. That’s why I love that they’re focused on real careers, entrepreneurship in pool-servicing, and nursing.

They’ve got kids. Of course, they’d rather spend their time as a family than side-hustling (unless their kids are running around yelling “6, 7!”—then I’d personally DoorDash just to get out of the house).

Anyway… rant over. 😅

My General Thoughts:

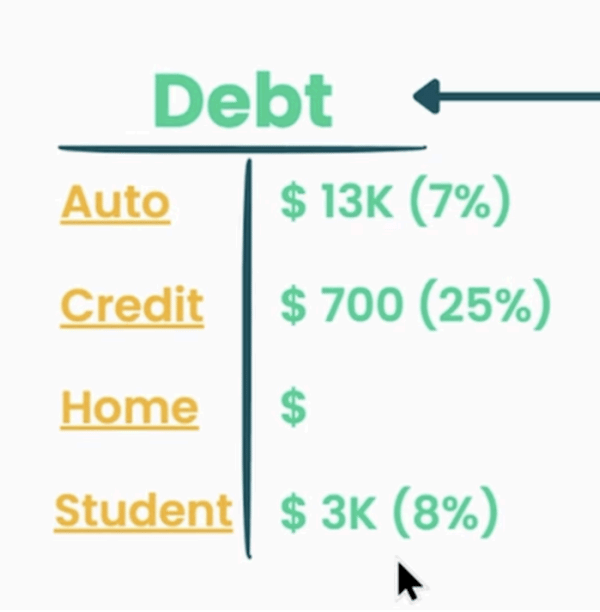

Our auditee said, “I feel like paying off debt is the vibe”. While I don’t understand what this means, I agree…with a slight addition. At the end of each month, he has about $2,000 to utilize. He could:

Build a Newbie Emergency Fund—1 month of expenses: $4,000.

Pay off his debt in order of highest interest rate, aiming to be debt-free in under two years.

Build an Expert Emergency Fund—6 months of expenses: $24,000.

To catch up on retirement savings—2x his income by age 35— he’ll need to invest around $2,500/mo (don’t shoot the messenger). Either he makes a small sacrifice for the next few years, or a substantial one later in life (working longer).

Systems > Motivation. He needs to build a system to save and invest automatically. This takes minutes to do and pays dividends for years.

Watch The Full Video Here:

Want to be audited live? Join our Audits every Tuesday & Thursday at 6 P.M. PST on Twitch

Challenge, Should You Choose to Accept…

This week, identify one way to increase your income by at least $100–$200 a month—preferably a salary negotiation, a skill you can monetize, or a side-hustle.

Want to be featured in next week’s newsletter? Reply to this email and share how you increased your income.

How Rich Nerds Are Spending Their Time

Justin, playing ARC Raiders. Bro’s posture is cooked.

“ARC Raiders is an incredible addition to the extraction shooter genre. It is the perfect blend of well made PvP and incredible PvE that requires community interaction. The developers have made the most incredible gem here, and I can’t wait to see where they go with it.”

Want to be featured in next week’s newsletter? Reply to this email and share how you’ve been nerding out!

This content is for educational purposes only and is not financial advice. I am not a licensed advisor—please consult a qualified professional for guidance on your personal situation. You know, someone who wears ironed collared shirts and sips from a ‘Freak in the Sheets’ mug.

Reply