- Rich Nerd

- Posts

- Are Pokemon Cards a Good Investment?

Are Pokemon Cards a Good Investment?

My Rich Nerds,

Last year, I met someone who proudly counted their TCG Player Pokémon portfolio as part of their net worth (Pedro, I’m looking at you).

In August, on the most isolated landmass on earth, The Maui News ran the headline: “Pokémon cards, merchandise lure Gen Z investors, others to Target.” Hat tip to Rich Nerd member Jonathan C. for sending the article my way. The story described teenagers sleeping on the grass outside the local Kahului Target, eager to “invest” in the newest release.

And then there’s Logan Paul, who dropped $5.3 million on a Pikachu Illustrator card.

Which brings me to today’s burning question — the “is a hot dog a sandwich?” of finance: Are Pokémon cards a good investment?

Below, I’ll define what an investment is, discuss the arguments for and against Pokémon cards as an investment (to make high school debate teachers across America happy), and then give my verdict.

What is an “Investment”?

Quick distinction: when I say “invest in Pokémon cards,” I mean buying and holding cards, as opposed to tearing open packs hoping to pull the most valuable card in the set. That’s gambling, my friends.

Anyway... what’s an investment? Simply put, it’s an asset bought with the expectation it’ll make money in the future. The keywords here are asset and expectation. An asset is something that puts money in your pocket, and expectation is how sure you are that what you’re buying will actually make you money. Conversely, a liability is something that costs you money over time. Like cars, or my 2 cats that I would do anything for.

For example, the stock market has historically returned a 10% annualized average return. Similarly, real estate has appreciated roughly 3% per year. Those are investments, reliable ones at that.

The Case for Pokémon Cards as an Investment

Scarcity sells. It’s Economics 101: when supply is limited and demand stays high, prices rise. Rare first editions and misprints have skyrocketed in value. Take Charizard, for example—some early buyers paid just a few dollars in 1999. Today, a first-edition holographic Charizard can fetch around $300,000 at auction.

Nostalgia: Whether you like them or not (and you better not like them), the latest generation of Star Wars movies proves one thing — reconnecting with a piece of childhood feels good, and people are willing to pay for it. Nostalgia sells.

The same kids who once traded Pokémon cards on the playground are now adults with disposable income, creating more demand for the same limited supply and feeding into scarcity, which in turn drives prices even higher — especially for rarer, more coveted cards.

Growth: As of late 2025, Pokémon stands as the highest-grossing media franchise in history, boasting over $103 billion in total retail sales since 1996. Now that is franchise value. People associate Pokémon with success — and in conjunction with hype for Pokémon cards, that recognition forms a powerful flywheel. Nothing draws a crowd like a crowd, resulting in more demand, again with the same supply.

The Case Against Pokémon Cards as an Investment

Lack of Historical Data: We know how many Pokémon cards exist (~75 billion), but not how many are valuable or what they sell for. Transaction data is fragmented and mostly private. On the other hand, stocks are fully transparent — every trade, price, and share count is publicly available. Similarly, real estate is broadly transparent — property records and price indices are public, with decades of historical data.

Paper or plastic: Pokémon cards… they look cool, but at the end of the day, they’re just pieces of paper with ink on them. Stocks, on the other hand, represent ownership in cash-generating businesses. Real estate is a tangible asset—you can live in it, rent it out, or sell it for income.

Risky Business: Idiosyncratic risk refers to the unique risks that affect a specific company, asset, or industry — but not the broader market. Pokémon as a company, and Pokémon cards as an asset class, are no exception. Just because a brand has thrived for nearly thirty years doesn’t guarantee it will continue to do so. One business decision or bad PR event could instantly tank the value of your card portfolio.

Don’t believe me? Look no further than the Counter-Strike franchise: a single (recent) game update reshaped the skins market overnight and wiped out $3 billion in value — that’s right, with a B. Index funds (for example) are not exposed to this kind of risk.

Liquidity: You can’t just click “sell” and call it a day. You need buyers, time, and marketplaces that charge fees—not exactly liquid. If someone isn’t willing to pay, you could be stuck holding the bag.

My Take

There is too much risk and uncertainty for Pokémon cards to reliably generate a return on investment. As such, they should not be a staple of your portfolio. That said, if you enjoy the thrill of speculation, feel free to allocate up to 10% of your portfolio to it. For my portfolio, it’s a huge “hell no”. I'd much rather invest in Pokémon the company (if they were publicly traded) instead of cards.

Why You SHOULD Buy Pokémon Cards

The biggest issue I see is people feeling the need to justify buying Pokémon cards by calling them an “investment.” As we just learned, they’re not great — and that’s perfectly fine.

The whole point of saving and investing your money is to enjoy life (which includes spending on things you love NOW), while still preparing for the future.

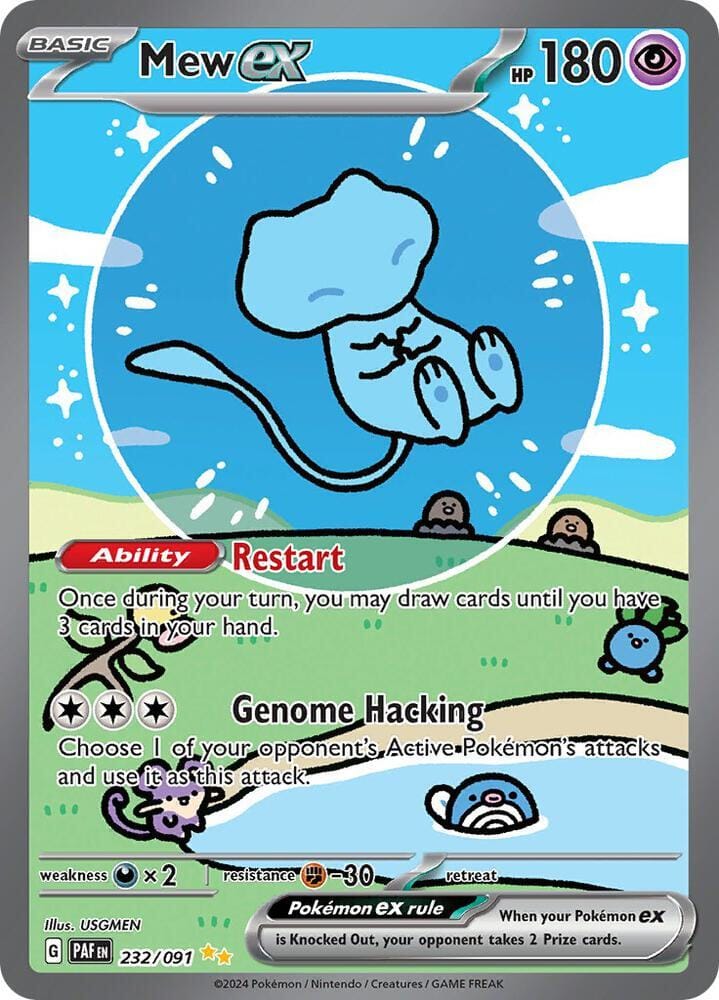

So, if you enjoy collecting Pokémon cards, buy them! Take my awesome wife, for example: her eyes light up when she’s looking at cards and ripping packs open. She’s currently on the hunt for a Paldean Fates Bubble Mew — wish her luck!

Don’t worry, if this ever turns into an unhealthy obsession, I’ll personally drop her off at rehab. And if I start dropping $500 at Uniqlo (I’ve developed a new addiction), my wife will absolutely drop me off at rehab. But hey, at least I’ll be the freshest-looking patient there.

Reply