- Rich Nerd

- Posts

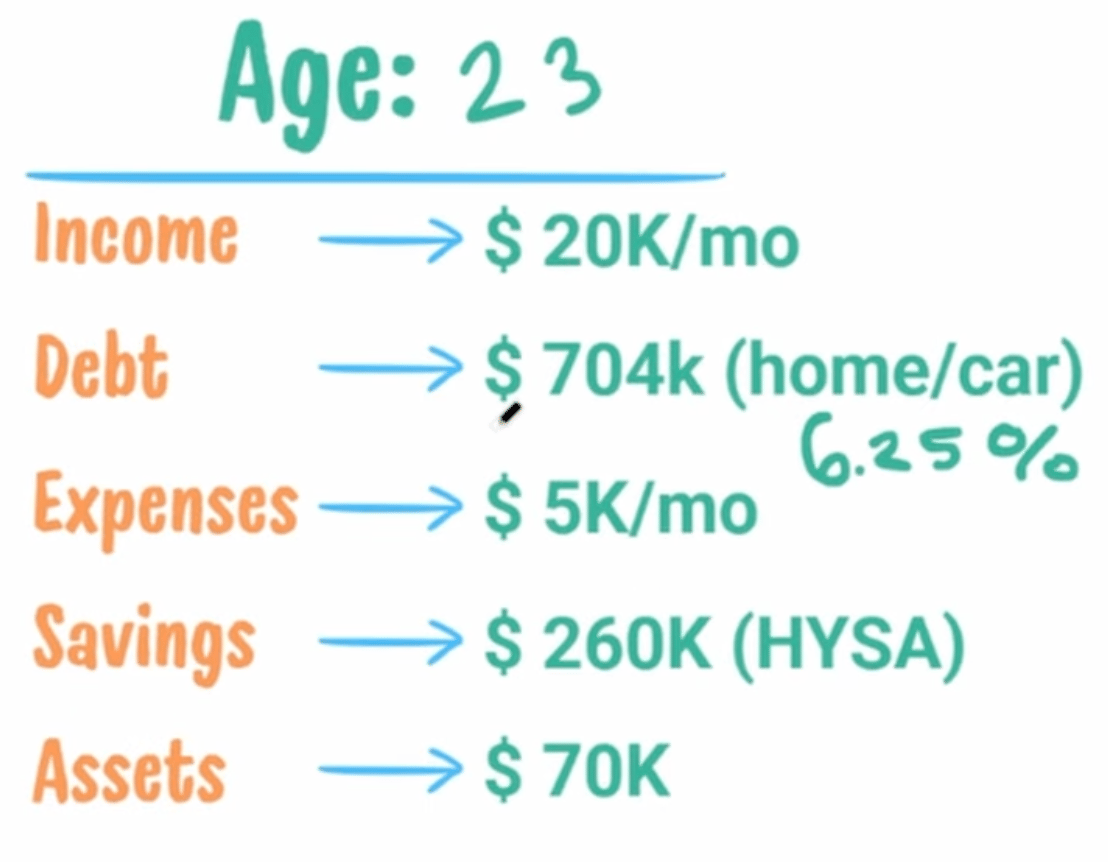

- He's 23, Making $20K/Mo – Has No Idea What to Do With It

He's 23, Making $20K/Mo – Has No Idea What to Do With It

“I’m a photographer.”

My Rich Nerds,

If I handed you a dollar, what could you really do with it? Not much—you couldn’t even buy an item at the dollar store; items now start at $1.25. But if I gave you $260,000, the possibilities would open up fast. You could buy a home in Omaha, go all in on Bitcoin, or snag a 1st edition holographic Blastoise. As your options expand, so does your hesitation. More money doesn’t always bring clarity—it often brings analysis paralysis…which is the state a recent auditee came to me in.

He’s 23, from Boston, and earns $20,000 a month after taxes as a real estate photographer (Note: he indicated that this was extremely conservative). He’s sitting on $260K in a high-yield savings account, unsure what to do next. Let’s dive into the numbers. And remember: you are never “behind” on your money journey. We’re all just on different levels.

My General Thoughts

He has the cash, so as a quick win, he should pay off the $4K car loan—easy peasy.

Next, he should establish an emergency savings fund in a high-yield savings account. With his current cash, he could allocate enough to cover 9 months of expenses, around $45K. He expressed some hesitancy with that number, so we agreed on $50K. It’s called “Personal Finance” for a reason—it isn’t a one-size-fits-all rule. If you need a greater sense of security for your emotional well-being, it’s perfectly fine to aim for a larger emergency fund.

Our auditee mentioned two goals: paying off his mortgage in less than 30 years and increasing his stock holdings. So how does he allocate this $200,000? Like everything else in life, it depends…

Charles Schwab recently analyzed various investing strategies. TLDR: the lump-sum investing method— investing as much as possible immediately— is the second-most successful strategy and the most reliable. The first place went to the “Perfect Market Timing” strategy, which you all know, is impossible. If someone claims otherwise, maybe never interact with that person again (and definitely don’t buy their course).

With this in mind👇Let’s look at a few scenarios

Scenario 1: He invests $200,000 (and not a penny more) in a low-cost index fund and earns an average annual return of 7%, after inflation. After 30 years, his investment will have grown to a remarkable $1,522,451. To further minimize taxation, he maximizes contributions to his Solo 401(k), Roth IRA, and HSA accounts. This entire process will only take roughly 20-30 minutes.

Scenario 2: He does a $200,000 Mortgage Recast. Assuming he made a 20% down payment ($140,000), his payment would be $3,975, resulting in $681,286 in interest paid over the life of a 30-year loan (this is why banks LOVE mortgages).

A $200,000 recast would reduce the principal to roughly $340,000, reducing his monthly payment $2,744, and total interest paid falls to $437,969 over 30 years. Note: to keep things simple, we kept a 30 year term (even though his is less).

He also mentioned wanting to pay off the mortgage in 15 years. With that accelerated schedule, his monthly payment would rise to $3,614, but his total interest paid would shrink dramatically to just $195,610. In other words, he could pay less than he is currently paying each month and save $485,676 in interest over the life of the loan.

Scenario 3: He invests $100,000 (like scenario 1) and does a $100k mortgage recast (like scenario 2). This blended approach allows him to benefit from market growth while also reducing debt and future interest costs.

After 30 years, his investment would have grown to an impressive $761,225.50.

Maintaining the 30-year mortgage, his payment would decrease from $3,975 to $3,359, and total interest paid would drop from $681,286 to $559,628, resulting in a savings of $121,658 in interest.

TLDR: I’m cool with ANY of these options. What I’m not cool with is him sitting on a sh*t load of cash for too long. This is what we call an opportunity cost.

Watch the audit to find out his highest-grossing month as a photographer:

Want to be audited live? Join our Audits every Tuesday & Thursday at 6 P.M. PST on Twitch

Challenge, Should You Choose to Accept…

Our auditee was fortunate—they found a way to turn their passion into a career early. For me, it took a little over two years to leap from software engineer to content creator.

Here’s a challenge for you: spend at least one hour a day on a side project that blends passion with profit—or at least the potential for profit (yes, this might mean playing a little less Valorant—but your future self will thank you).

It could be anything: niche content around your favorite game, an app you’ve been dreaming of, or even making ceramic pots.

Want to be featured in next week’s newsletter? Reply and share what you’re building!

How Rich Nerds Are Spending Their Time

I watched Chainsaw Man – The Movie: Reze Arc in theaters. OMFG—it was sooooooo good. The animation, music, sound effects, story—everything was world-class. Easy 10/10.

Beyond that, the hallo was weening. My wife and I have been viewing horror movies (can’t wait to do it again next year).

Alex, a member of the Rich Nerd community, recommended Gonjiam: Haunted Asylum. It did not disappoint. Now I only expect top-tier recommendations from you, Alex. Don’t disappoint…or else…

Want to be featured in next week’s newsletter? Reply to this email and share how you’ve been nerding out!

This content is for educational purposes only and is not financial advice. I am not a licensed advisor—please consult a qualified professional for guidance on your personal situation. You know, someone who wears ironed collared shirts and sips from a ‘Freak in the Sheets’ mug.

Reply