- Rich Nerd

- Posts

- He's 31, Makes $6K Per Month But Lives in His TRUCK

He's 31, Makes $6K Per Month But Lives in His TRUCK

“I’m a Driver, Baby.”

Disclaimer: Taylor drives a truck, not like this

My Rich Nerds,

At 31, Taylor nets $6,000 a month after taxes as a long-haul truck driver. He team-drives with his partner, living full-time on the road and calling their truck, home.

But this lifestyle didn’t come overnight.

Taylor started his career working at Walmart and a fast-food chain. He later became a school bus driver—not for the love of kids, but for a better paycheck. Eventually, he switched to driving a garbage truck for even more income. Two years ago, he made another leap—into long-haul trucking—for the same reason: higher pay.

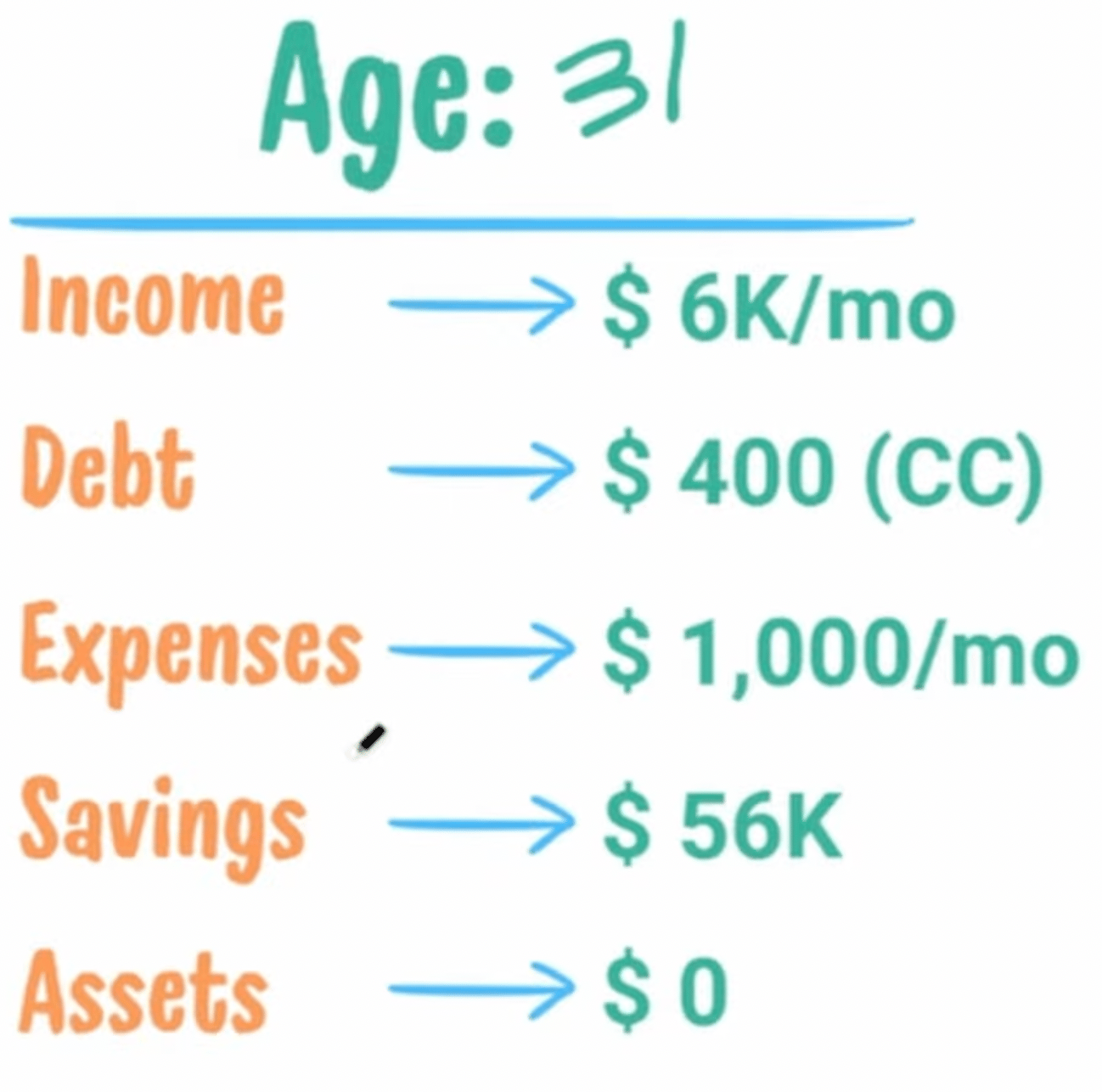

His financial goal was to save $600,000, believing that reaching this amount would finally allow him to start enjoying life. I helped him move from an unclear financial goal to a step-by-step plan. Here’s a quick snapshot of his financial situation. And remember: no one is ever “behind” on their money journey — we’re all just on different levels.

My General Thoughts

To achieve a quick win, being debt-free, I encouraged Taylor to pay off his credit card and set up auto pay. Easy peasy.

Taylor is 31 with no retirement savings, so the priority is to start contributing immediately. According to Fidelity, he should have 2x his salary invested for retirement by age 35. Given his low expenses and high income, he can build momentum quickly!

Taylor believed a 401(k) was a scam, so he chose not to contribute (we can thank grifters and insurance salespeople for this). While 401(k)s are often misunderstood, they’re not a scam. A 401(k) is a retirement investment account that allows you to invest in the stock market and other assets, while saving you money on taxes.

Historically, the market has returned an average of 10% annually — a powerful tool that millionaires (such as myself) have used for building wealth over the long term.

Many employers offer a 401(k) match, which is free money. We love free money. Taylor should contribute enough to get his full company 401(k) match!From there, maxing out a Roth IRA is a smart next move. Contributions to a Roth grow tax-free, and qualified withdrawals in retirement won’t cost him a dime in taxes — a huge win in his golden years.

One moment you're 31, with joints and tendons doing exactly what they’re supposed to. Next, you're using a walker as both a mobility aid and a makeshift table for your rice pudding. Don't wait. Enjoy life now. That's why I urged Taylor to put at least 10% of his earnings into a bucket labeled “Splurge Fund.” So he can book that trip to Paris—or buy toys for his three Sphynx cats: Stitch, Pinky, and Paul.

Watch the audit for the full roadmap—or skip to 9:25 to hear Taylor officially call me ‘the GOAT.’ His words, not mine:

Want to be audited live? Join our Audits every Tuesday & Thursday at 6 P.M. PST on Twitch

Challenge, Should You Choose to Accept…

You can’t change what you don’t see. Starting today, I challenge you to track your expenses. You can go old-school with pen and paper by candlelight, sure—but it’s 2025, and there are plenty of apps* that make it way easier.

Want to be featured in next week’s newsletter? Reply to this email and share what area of your spending surprises you the most.

What Our Rich Nerds Are Up To

“Today I hosted a chess club. My first opponent, an 85-year-old, absolutely cooked me with zugzwang in a pawn endgame—all while lecturing me on the downfall of America, starting with Thomas Jefferson. My next opponent screamed, “Don’t take my poo poo!” on move two. His mom clarified: “Poo poos are pawns in our household.” Poo poos are pawns in my household now, too.”

- Jonathan C. (Rich Nerd community member)

Want to be featured in next week’s newsletter? Reply to this email and share how you’ve been nerding out!

This content is for educational purposes only and is not investment or tax advice. I am not a licensed advisor or tax professional—please consult a qualified professional for guidance on your personal situation. You know, someone who wears ironed collared shirts and sips from a ‘Freak in the Sheets’ mug.

*This is an affiliate link. I may earn a commission if you use it—at no extra cost to you.

Reply