- Rich Nerd

- Posts

- Nanny Doesn’t Want to End Up Like Her Immigrant Parents

Nanny Doesn’t Want to End Up Like Her Immigrant Parents

My Rich Nerds,

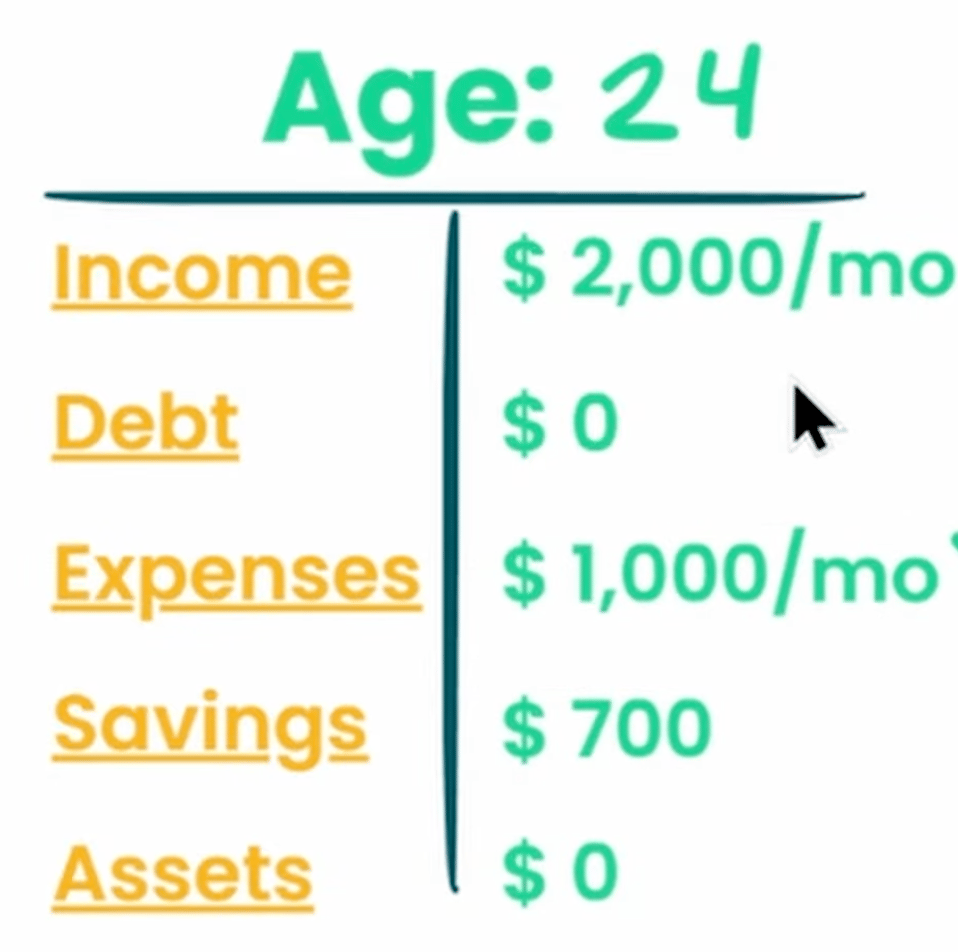

She’s 24 and earns about $2,000 a month working as a nanny. She has no debt and incredibly low expenses, but she also has minimal savings, no investments, and no financial strategy. In the back of her mind, there’s a constant fear that she’ll end up like her parents — working forever, barely scraping by, and never reaching stability. Let’s dive into her numbers.

My Initial Thoughts:

Our auditee feels behind at just 24 years old. She even said herself that she shouldn’t compare her progress to others, and she’s absolutely right. She is not behind. In fact, she’s in a genuinely strong position: she has no debt, extremely low expenses, real potential to save, and, most importantly, the motivation to change her situation. That combination puts her ahead of most people her age.

At first, she told me her expenses were about $300 a month. With $700 in savings, that felt surprisingly low to me. It seemed like she should have more left over, but I wasn’t sure where the rest was going. She mentioned that she loves dropping Benjamins on her nieces to secure the “Best Auntie” award. I can get behind that—guilt-free spending is great, and she should keep doing what brings her joy.

But even that didn’t fully explain why her savings weren’t higher. Then it came out that she also gives her parents money for rent, and the amount varies from month to month. There’s absolutely nothing wrong with supporting your family or paying your share—we all have to be adults—but I pointed out that it would help her to contribute a set amount each month. That way, she’d know exactly what her expenses are and could work toward financial stability first before helping others out.

During our call, it came up that she’s been influenced by TikTok creators promising things like “make money while you sleep” and “turn a little money into a ton of money.” My heart rate always spikes when this topic comes up. Please, no “you’re getting old” jokes, I’m fragile. Anyway, these influencers are out here peddling speculative nonsense and calling it a strategy. They sell hype, not wealth-building. And here’s a rhetorical question for Rich Nerds: would you rather follow a path to wealth that’s as close to guaranteed as possible, or gamble your future on whether you happen to get lucky day trading? Exactly.

Her goal is to move out of her parents’ home and stay in the Monterey Bay area. It’s a great long-term ambition, but with California prices and her current income, it’s not a realistic option right now.

That doesn’t mean it’s off the table—it just means it’s something to work toward strategically as her income grows and her financial foundation strengthens.

My General Thoughts:

She should start by saving $1,000 as a Newbie Emergency Fund, even a small emergency fund dramatically increases confidence and reduces stress. Then work her way to $3,000 — roughly three months of expenses — and eventually reach $6,000 for a full six-month Expert Emergency Fund. All of this money belongs in a high-yield savings account. I recently compared high-yield savings accounts here.

Once her emergency fund is in place, the next step is to open a Roth IRA. This will be her first true investment account and her introduction to becoming a partial owner of companies whose value grows over time. Ideally, she contributes around $250 per month, but even $100 is a complete win. It grows tax-free, allows tax-free withdrawals in retirement, and transforms small, consistent contributions into hundreds of thousands over the decades. It’s not flashy, it’s not TikTok-trendy, but it works.

The final pillar is increasing her income. The hard truth is that you can’t side-hustle your way out of a low income. She can flip furniture, but that type of money is hamster-wheel income: lots of effort, very little long-term change. The real solution is raising her primary income. She’s considering becoming a teacher, which would require schooling and some upfront costs, but increasing her earnings from $2,000 a month to $4,000–$6,000 a month would radically transform her financial trajectory and her retirement. Her income is her ultimate ability; used wisely, it changes everything.

Watch the full audit:

Want to be audited live? Starting in January 2026, Join our Audits every Tuesday & Thursday at 6 P.M. PST on Twitch

Challenge, Should You Choose to Accept…

Treat yourself to something this week from your guilt-free spending fund.

Want to be featured in next week’s newsletter? Reply to this email and share what you decided to buy.

How Rich Nerds Are Spending Their Time

“I’ve been staying inside and working on projects all day. I’m learning AI and using it to make things. I used Claude AI to code a Minecraft mod because my friend, who’s an engineer, said Claude is really good at coding compared to GPT-5. I have zero coding knowledge, it’s like learning Chinese for me, so I rely on it completely and focus on giving it ideas and feedback. My goal is to push the AI to its limits and see what it can do. My next project might be creating an automation tool that uploads videos across all social media platforms with just a few clicks.”

- Nightla

Want to be featured in next week’s newsletter? Reply to this email and share how you’ve been nerding out!

This content is for educational purposes only and is not financial advice. I am not a licensed advisor—please consult a qualified professional for guidance on your personal situation. You know, someone who wears ironed collared shirts and sips from a ‘Freak in the Sheets’ mug.

Reply