- Rich Nerd

- Posts

- She has $60K at Age 21 and Needs a Plan

She has $60K at Age 21 and Needs a Plan

Meet Krissee

Krissee is 21 years old and proudly from Sacramento, California—yes, she’s well aware there’s “nothing to do there,” thank you for reminding her.

She came to me looking for a financial roadmap—something tailored to her current assets and expenses—and to see if her short-term goals were actually within reach. At the top of her list: taking her family to Brazil this year and investing in a quality gaming PC.

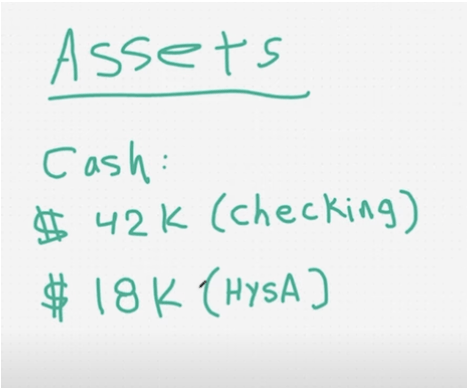

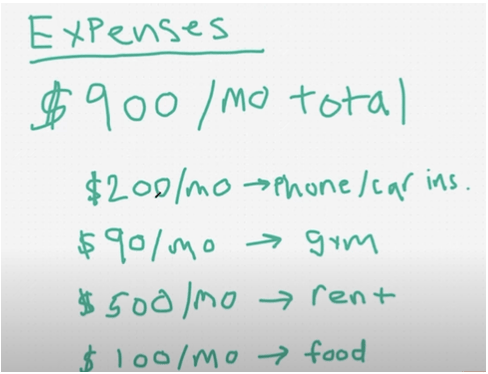

Here’s a quick snapshot of her financial situation. And remember: no one is ever “behind” on their money journey — we’re all just on different levels.

|  |

My General Thoughts

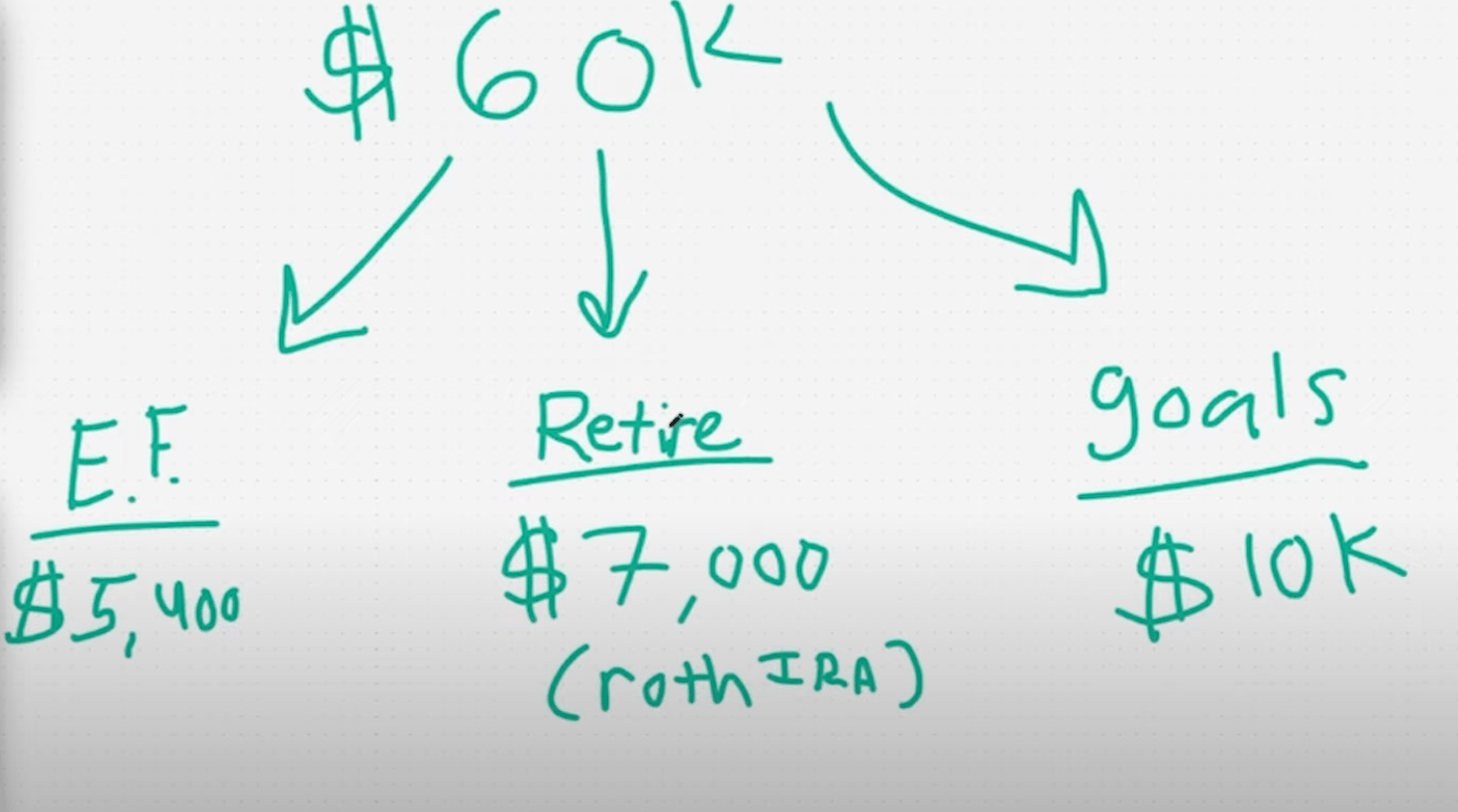

By saving the unsexy, Buffett-approved way, Krissee has stacked up $60K. Now, with this war chest she should contribute to three buckets: emergency savings, retirement , and spending money.

I outlined the following:

According to Bankrate, only 27% of Americans can cover a six-month emergency — we don’t want Krissee to be one of them. Her monthly expenses are about $900, so we calculated 6 × $900 = $5,400 as her emergency fund target.

One of the biggest themes in personal finance is using time to your advantage through the all-powerful force of compound interest. We want her to max out a retirement account this year (Roth IRA).

$10k to go toward her short-term goals.

Krissee can put her leftover funds (~$37,000) into a high-yield savings account or a brokerage, but it’s just as important she spends on what she loves (such as Goodwill thrifting)—money’s not just for growing, it’s a tool for living.

Watch the full audit to learn Krissee’s biggest revenue source :

Check out Krissee’s socials here.

Want to be audited live? Join our Audits every Tuesday & Thursday at 6 P.M. PST on Twitch or TikTok and request to be added to the queue.

Challenge, Should You Choose to Accept…

Open a HYSA (High-Yield Savings Account) and deposit at least $1 into it. Check out my recent video where I break down the pros and cons of five different banks (bank I use).

If you already have a HYSA, Deposit at least $1 into your HYSA.

Want to be featured in next week’s newsletter? Email me and share how completing the challenge made you feel.

How I Nerded Out This Week

My wife, a friend, and I have been playing nothing but Escape from Tarkov.

The game is ruining my life, messing with my sleeping patterns and cutting into my damn reading time.

Here are a few features that keep me coming back:

1. The mechanics are hyper realistic. Even tea bagging enemy (or friendly) bodies costs stamina lol.

2. The audio is amazing. The gun shots, bushes you walk through, doors, and even the persistent grunting sounds people make after getting shot (until you heal).

3. You MUST play smart. You can't just run around like in Call of Duty or you'll die from one shot and lose all your gear (which can be painful).

4. There’s friendly fire—and you never know who’s really on your team—which makes every raid nerve-wracking and exhilarating.

Want to be featured in next week’s newsletter? Email me and share how you’ve been nerding out!

This content is for educational purposes only and is not financial advice. I am not a licensed advisor—please consult a qualified professional for guidance on your personal situation. You know, someone who wears ironed collared shirts and sips from a ‘Freak in the Sheets’ mug.

Reply