- Rich Nerd

- Posts

- She’s 28, Has $3 in the Bank, and $31,000 in DEBT

She’s 28, Has $3 in the Bank, and $31,000 in DEBT

“My Finances Are in the Drain Right Now.”

My Rich Nerds,

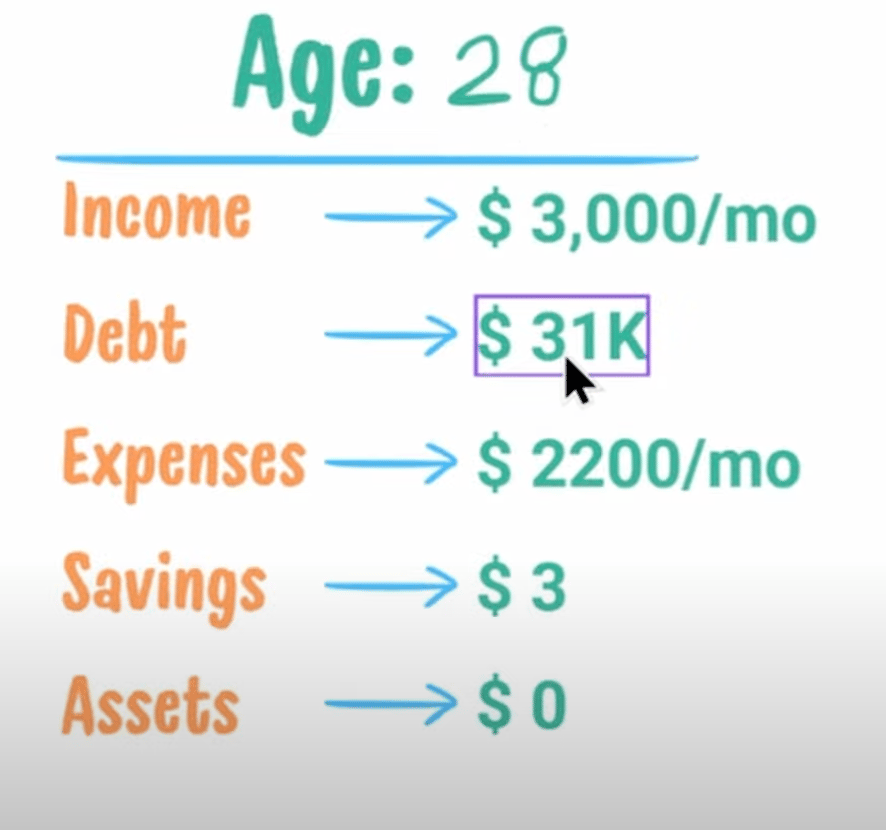

Recently, a 28-year-old from the Midwest was audited on one of our live streams. She works full-time as an order processor for a home improvement company. But despite putting in the hours, she feels like she just can’t get ahead financially.

At the time of the live stream, she had $3 in her bank account and $31,000 in debt.

Let’s dive into her numbers and build an escape plan. This part of the newsletter is for all you Nosy Nellies (yes, especially you, Alex, my awesome assistant).

And remember: you are never “behind” on your money journey. We’re all just on different levels.

|  |

My General Thoughts

First, a pop quiz: What Percentage of Americans Live Paycheck to Paycheck?

a) 17%

b) 29%

c) 41%

d) 67%

According to a recent study by PNC Bank, the correct answer is nearly two out of every three Americans are currently living paycheck to paycheck. Our auditee is one of them.

I outlined the following vital first steps:

First, she needs to build her newbie emergency fund—1 month of essential expenses. This isn’t about creating a full financial fortress (6 months of expenses) just yet. It’s about having a basic shield so that one unexpected expense doesn’t knock her off track.

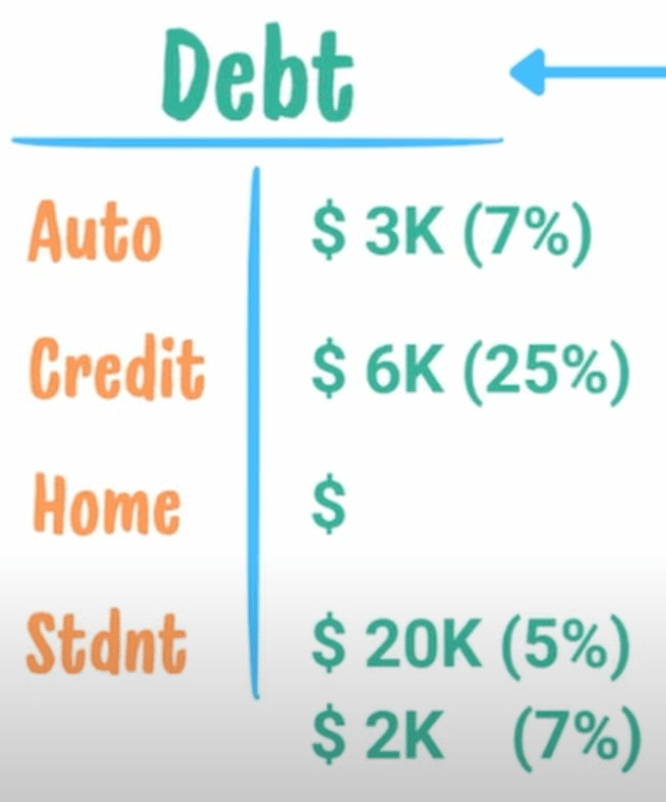

Since her high interest rate debt will outweigh potential investment gains, the focus should be on the credit card (25%) first. Using the avalanche method, she'll pay down her debt by making large extra monthly payments and be debt-free in 9 months for $680 interest 💪

After that, she’ll shift focus to the car loan, aiming to pay it off in about 5 months. The avalanche method is all about maximizing savings—taking down the Final Boss first.

The snowball method, which focuses on clearing the smallest debts first, regardless of interest rate, is another great strategy. It's designed to create quick wins that build motivation and momentum. Each time a debt disappears, it feels like progress—which can be powerful for staying on track.

Or… she could unlock a cheat code: the balance transfer.

How it works:

Apply for a new card with a balance transfer promo (0% APR).

Move your high-interest balance(s) over.

Pay it down during the promo window—interest-free.

Watch out for:

Balance transfer fee: 3%–5% of the transfer amount.

Credit limit: You can only transfer what you're approved for.

Same issuer rule: No transferring from Chase to Chase, etc.

Promo deadline: Once it ends, the rate shoots back up

In her case, she could end up paying around $180 to $300 in balance transfer fees, which still saves her at least $380. But it's important to make sure the credit card is paid off before the promotional deadline — otherwise, we're just kicking the can down the road.

Watch the full audit to listen to my angelic voice and see the full roadmap :

Want to be audited live? Join our Audits every Tuesday & Thursday at 6 P.M. PST on Twitch.

Challenge, Should You Choose to Accept…

By the end of the day, contribute as much as you can to your emergency savings fund — whether you're working toward building your newbie fund or aiming for a full six months of expenses. Every bit counts!

Want to be featured in next week’s newsletter? Reply to this email and share how completing the challenge made you feel!

How I Nerded Out This Week

I’ve realized Escape From Tarkov can be painful to play sometimes, so I’ve mixed in playing Arena Breakout: Infinite.

Don’t get me wrong, this still keeps me on my toes. Someone named Captain Rat killed me last night and it almost gave me a heart attack. Don’t believe me, here’s my reaction:

Sometimes, my fingers need a break too, and I just want to use my eyes. My wife and I have been watching Alien: Earth. It’s good…but also weird.

Want to be featured in next week’s newsletter? Reply to this email and share how you’ve been nerding out!

This content is for educational purposes only and is not financial advice. I am not a licensed advisor—please consult a qualified professional for guidance on your personal situation. You know, someone who wears ironed collared shirts and sips from a ‘Freak in the Sheets’ mug.

Reply