- Rich Nerd

- Posts

- She’s 29 and Wants to File for Bankruptcy

She’s 29 and Wants to File for Bankruptcy

My Rich Nerds,

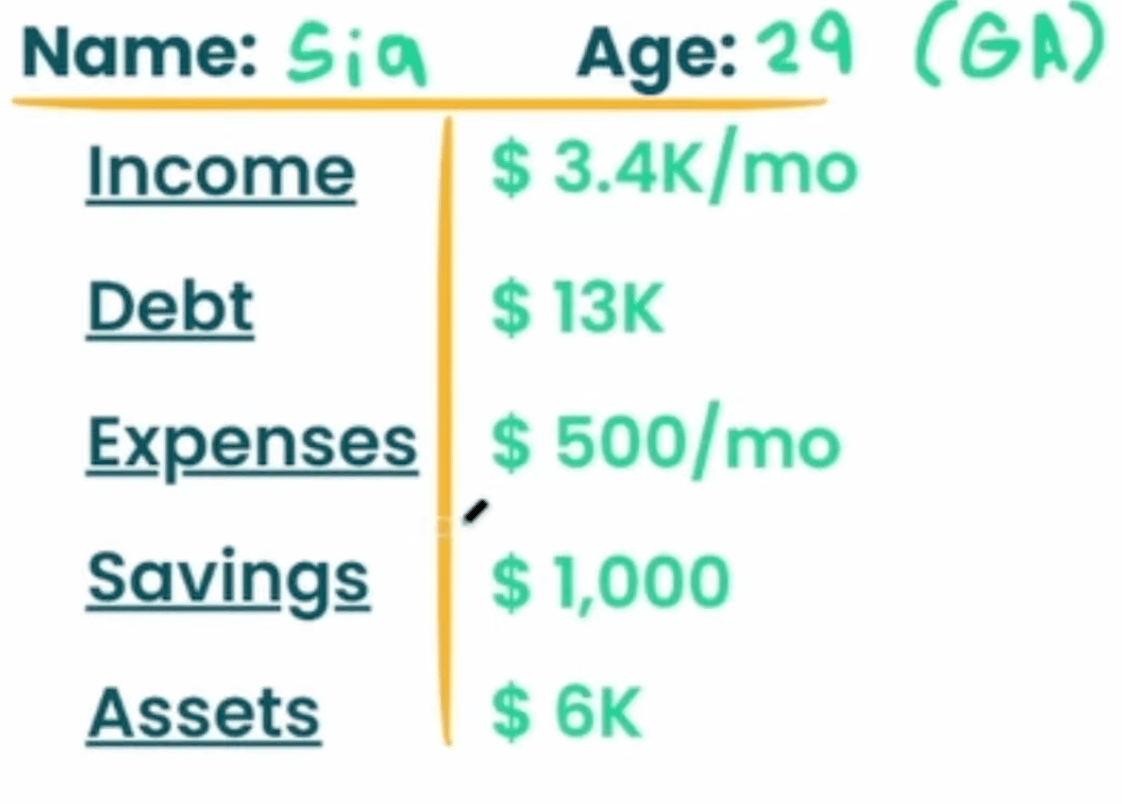

Meet Sia, a 29-year-old storage facility property manager from the Peach State, aka Georgia. You don’t just get financial tidbits from me, but geography facts too.

Her goals are to erase her debt, become more financially responsible, and buy a car (spoiler: her last car may have been repossessed). She says, “My head is full of opinions about whether I should file for bankruptcy or just go ahead and pay off my debt.”

So instead of guessing, let’s look at her actual numbers and build a plan that shows she’s not cooked.

|  |

My initial reaction was: “DO NOT file for bankruptcy”. She can easily pay this debt off, and here’s why. Her expenses are low AF! She lives in an on-site apartment at a storage facility with her doggo. Her apartment is subsidized by her company (sweet deal). Most of her spending goes toward food and a gym membership. She hasn’t really been splurging or “having fun” lately, and she doesn’t even have a car right now, so no gas or insurance to worry about.

That’s fantastic, because it means she has roughly $2,500 left over each month to allocate toward her goals 💪

Some people pour milk into the bowl before the cereal. The point isn’t that there are psychotic people out there (although there definitely are with Fortnite players. Guys, I really tried to like that game), it’s that people do things differently.

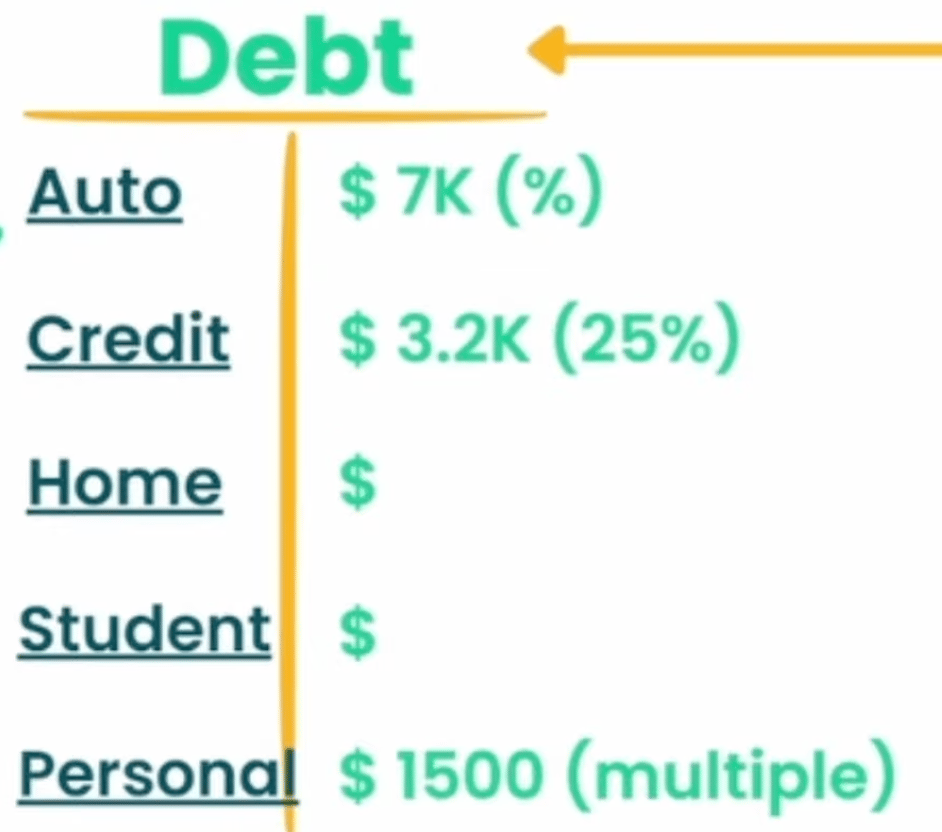

Normally, I recommend paying off the highest-interest debt first (credit card). But money is personal, and psychology matters. Some people need to see progress to stay committed to the plan. Sia is one of them. In her case, she can pay off her smallest balance (collections debt) in less than a month for an instant w. Then, she can focus on the credit cards, followed by the car repo loan. At that pace, she can be 100% debt free in under six months.

To shrink the total even faster, she should try negotiating the $1700 in collections debt. When a loan is in collections (like Sia’s), many lenders will settle for less, remove or freeze interest, or offer lump-sum discounts. Remember, the only people we don’t negotiate with are Flat Earthers, so it never hurts to call your friendly neighborhood debt collector.

I asked Sia how she got into debt in the first place. After taking full responsibility for her situation, she shared that she’s been a little too generous with her family. It’s easy to forget the wisdom from every airplane safety speech: put your own oxygen mask on first. Sia’s now focused on getting herself into a stronger position before trying to improve the position of others. Also, the word “no” is your best friend in life. Learn how to use it and watch your happiness skyrocket. You’re welcome.

I know what you’re thinking: “Now that she’s debt-free, she can finally get a whip!” Pump the brakes there, turbo. We still have more work to do.

Next, Sia should build a $3,000 Expert Emergency Fund (six months of expenses), ideally parked in a High Yield Savings Account*, for the rainy days all the elders warned you about growing up. She already has a band (for my fellow uncs out there, slang for $1K), so she can finish funding it in about a month.

After that, she should start investing 15% of her income toward retirement, ideally by maxing out her Roth IRA in 2026.

Once Sia clears these steps, she unlocks her next quest: buying a car. This is where MANY people accidentally respawn into debt. To avoid this, we recommend following the Rich Nerd Car-Buying Meta: buy a reliable used car in cash, and never spend more than 30% of your gross income. By sticking to this rule, Sia can comfortably shop in the $10,000–$15,000 range.

Sia told me, “Seeing it laid out in front of me is helpful.” And there's a reason for that. Our brains are designed to process visual information. A common issue I see with nearly every guest is that they try to manage their finances in their head. It doesn’t work.

That said, we’re pumped about this plan to help her avoid bankruptcy, be debt free, eliminate financial anxiety, and build a system to grow her wealth. The best part? She’ll still beable to do the things she loves, like travel 💸🤓

Watch the full audit here:

Want to be audited live? Join our live show every Tuesday & Thursday at 6 P.M. PST on Twitch, TikTok, and YouTube

*This is an affiliate link, and we may earn a commission at no extra cost to you.

Reply